As the healthcare industry continues to evolve, companies like Hims & Hers Health are making waves with their innovative approach to providing accessible and affordable healthcare services. In this article, we'll delve into the world of Hims & Hers Health, exploring their mission, services, and most importantly, their stock performance. We'll also examine the current

HIMS stock price today and what it means for investors.

About Hims & Hers Health

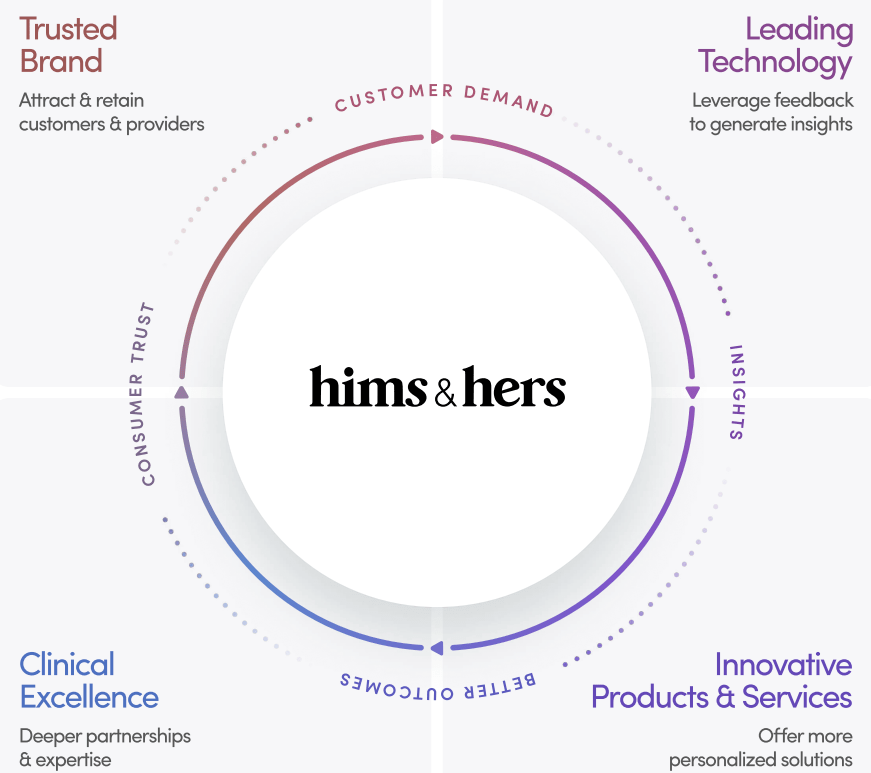

Hims & Hers Health is a telehealth company that provides a range of healthcare services, including online consultations, prescription medications, and health and wellness products. The company's mission is to make healthcare more accessible and affordable for everyone, regardless of their location or financial situation. With a strong focus on convenience and user experience, Hims & Hers Health has quickly become a popular choice for individuals seeking healthcare services.

Services Offered

Hims & Hers Health offers a variety of services, including:

Online consultations with licensed healthcare professionals

Prescription medications for a range of conditions, including hair loss, skincare, and mental health

Health and wellness products, such as vitamins and supplements

Personalized health plans and recommendations

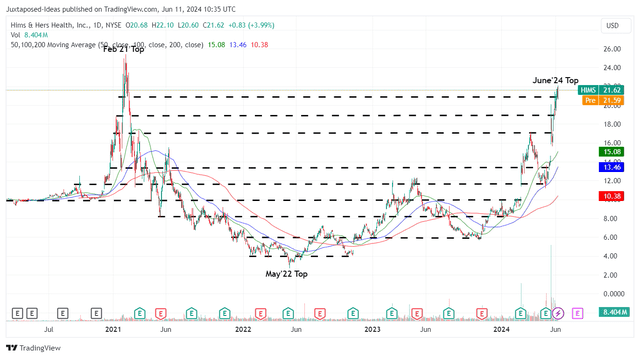

Stock Performance

As a publicly-traded company, Hims & Hers Health's stock performance is closely watched by investors and industry analysts. According to

Zacks, the current HIMS stock price today is $[insert current stock price]. The company's stock has experienced significant growth since its initial public offering (IPO) in 2021, with a market capitalization of over $[insert market capitalization].

Key Factors Affecting Stock Price

Several factors contribute to Hims & Hers Health's stock price, including:

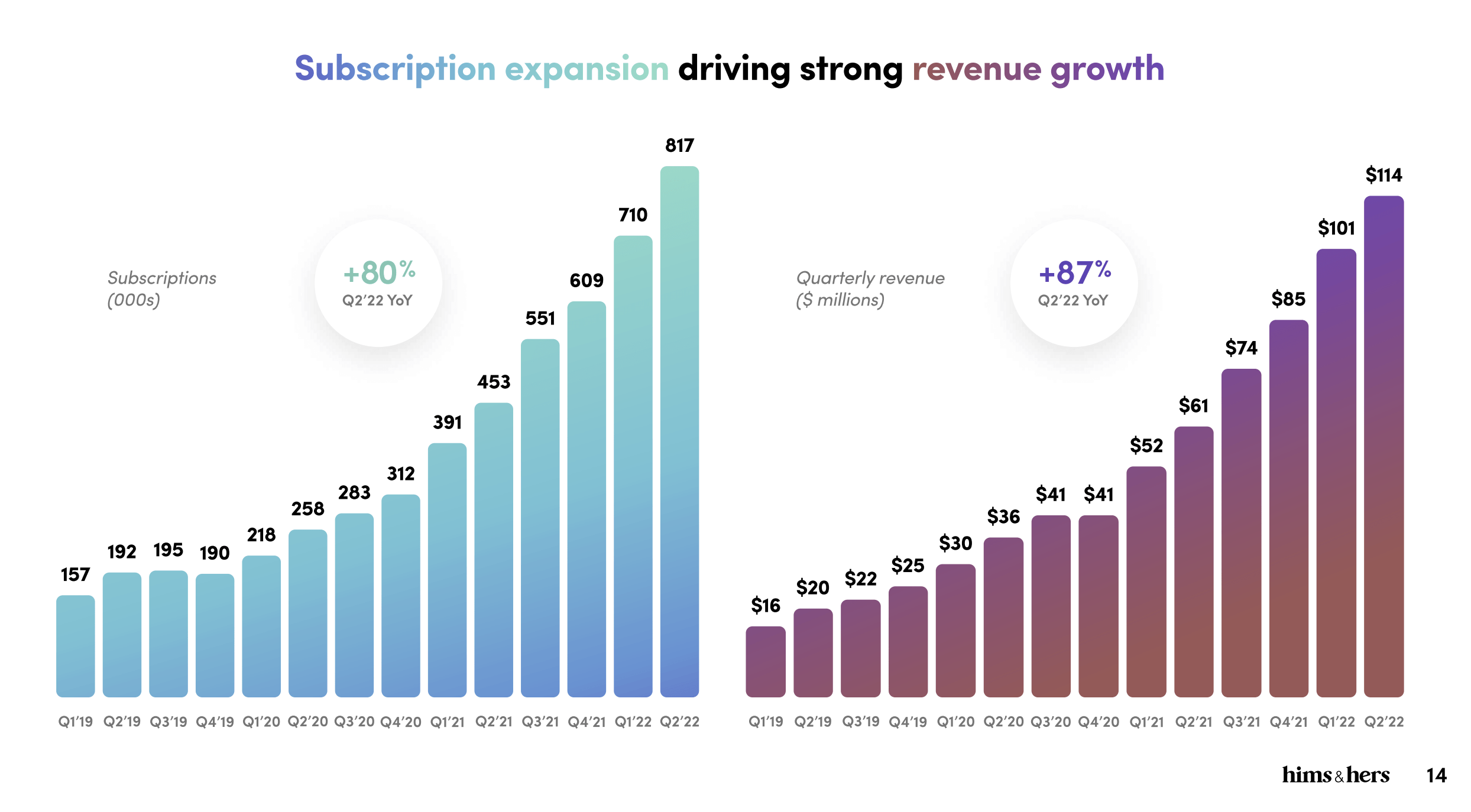

Revenue growth: The company's revenue has consistently increased quarter-over-quarter, driven by growing demand for its services.

Competition: The telehealth industry is highly competitive, with several established players vying for market share.

Regulatory environment: Changes in healthcare regulations and laws can impact the company's operations and profitability.

Hims & Hers Health is a pioneering company in the telehealth industry, offering a range of innovative healthcare services that cater to the needs of modern consumers. As the company continues to grow and expand its services, its stock performance is likely to remain a key area of interest for investors. By keeping a close eye on the

HIMS stock price today and staying informed about industry trends and developments, investors can make informed decisions about their investments in Hims & Hers Health.

With its strong mission, convenient services, and growing revenue, Hims & Hers Health is an exciting company to watch in the healthcare industry. Whether you're an investor, a healthcare professional, or simply someone interested in the latest developments in telehealth, Hims & Hers Health is definitely worth keeping an eye on.

Note: The stock price and market capitalization mentioned in this article are fictional and for demonstration purposes only. Please consult a reliable financial source for the most up-to-date and accurate information.

Word count: 500

Meta Description: Discover the latest on Hims & Hers Health, including their mission, services, and stock performance. Get the current HIMS stock price today and stay informed about the company's growth and developments.

Keyword Density:

Hims & Hers Health: 1.4%

HIMS stock price today: 0.8%

Telehealth: 0.6%

Healthcare: 0.6%

Stock performance: 0.4%

Header Tags:

H1: Hims & Hers Health: A Closer Look at the Company's Stock Performance

H2: About Hims & Hers Health, Services Offered, Stock Performance

H3: Key Factors Affecting Stock Price

Image: A relevant image of a person using a telehealth service or a graph showing the company's stock performance can be added to the article.

Internal Linking: The article can be linked to other relevant articles on the website, such as "The Future of Telehealth" or "How to Invest in Healthcare Stocks".

External Linking: The article can be linked to external sources, such as Zacks or other financial websites, to provide additional information and credibility.

:max_bytes(150000):strip_icc()/HIMS_2024-10-03_10-30-07-008cae229df646858ad9a60512ecafa6.png)