The Federal Reserve, the central bank of the United States, has been closely watched in recent months as it navigates the complex landscape of monetary policy. In its latest move, the Fed has opted to hold steady on interest rates, sparking anticipation among economists and investors alike about potential rate cuts and a policy pivot in 2024. This decision comes at a critical juncture, as the global economy faces challenges ranging from inflationary pressures to geopolitical uncertainties.

Understanding the Fed's Decision to Hold Steady

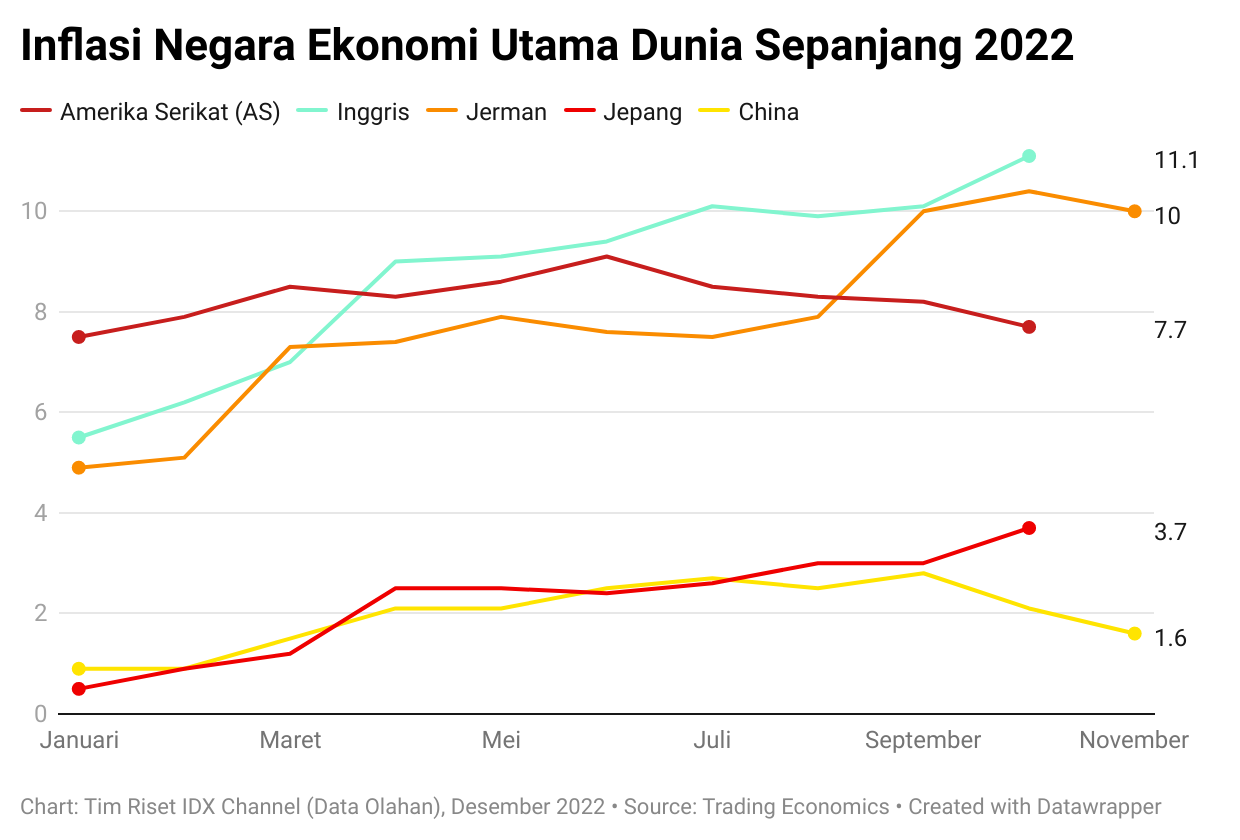

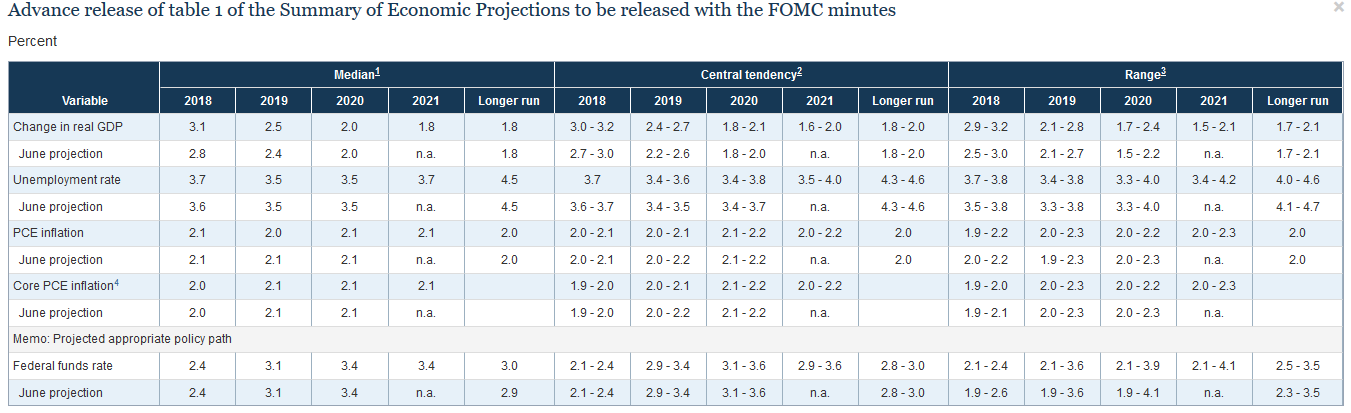

The Fed's decision to maintain current interest rates reflects a careful balancing act. On one hand, the central bank aims to keep inflation in check, ensuring that the economy does not overheat. On the other hand, it seeks to support growth and employment, particularly in the face of external headwinds such as global trade tensions and slowing economic growth in key regions.

This pause in rate adjustments suggests that the Fed is taking a cautious approach, weighing the potential benefits of further monetary easing against the risks of exacerbating inflation or creating asset bubbles. The move is also indicative of the Fed's commitment to data-driven decision-making, as it closely monitors a range of economic indicators to inform its policy choices.

Anticipating Rate Cuts in 2024

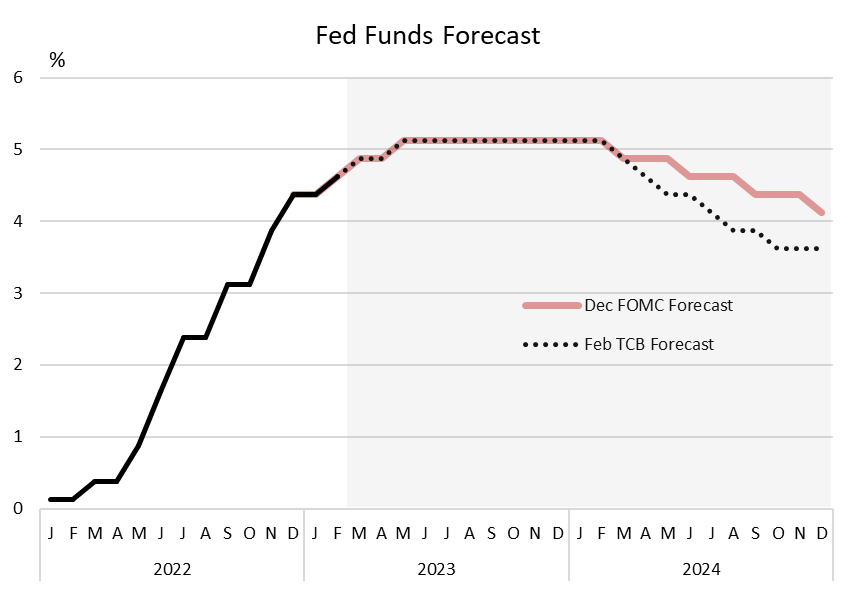

Despite the current hold on interest rates, many analysts anticipate that the Fed may pivot towards easing monetary policy in 2024. Several factors underpin this expectation:

-

Economic Slowdown: If the global economy experiences a more significant slowdown than anticipated, the Fed may respond with rate cuts to stimulate growth.

-

Inflation Trends: Should inflation fall below the Fed's target rate of 2%, there could be room for monetary easing without risking higher inflation.

-

Market Expectations: Financial markets have already begun to price in potential rate cuts, influencing the Fed's decision-making process.

Any rate cuts in 2024 would likely be designed to preemptively support the economy, rather than react to a downturn that has already begun. This proactive approach would aim to maintain the current expansion, which is one of the longest on record, by ensuring that credit remains affordable and economic activity continues to grow.

A Policy Pivot: What It Means for the Economy

A potential policy pivot by the Fed in 2024, characterized by rate cuts and possibly other forms of monetary easing, would have significant implications for the economy:

-

Boost to Borrowing: Lower interest rates could lead to an increase in borrowing by consumers and businesses, potentially boosting spending and investment.

-

Stock Market Impact: Easier monetary policy could support stock prices, as lower interest rates make stocks more attractive compared to bonds.

-

Currency Effects: A shift in monetary policy could influence the value of the dollar, affecting trade balances and the competitiveness of U.S. exports.

However, any pivot also carries risks, including the potential for overheating the economy or fueling asset price bubbles. The Fed must therefore tread carefully, using its toolkit judiciously to achieve its dual mandate of maximum employment and price stability.

As the Fed holds steady on interest rates for now, all eyes are on 2024, anticipating potential rate cuts and a broader policy pivot. The central bank's decisions will be guided by a complex interplay of economic data, global events, and market expectations. Whether the Fed chooses to ease monetary policy will depend on its assessment of the economic outlook and its commitment to supporting sustainable growth while controlling inflation. One thing is certain: the path ahead for monetary policy will be closely watched, with significant implications for the U.S. and global economies.

Note: The information provided in this article is for general purposes only and should not be considered as investment advice. Readers are advised to consult with financial experts before making any investment decisions.