The trucking industry is a complex and highly regulated sector, with numerous laws and regulations governing various aspects of operations. One of the critical areas of compliance is fuel tax, which can be a daunting task for fleet owners and operators. This is where IFTA, Inc., or the International Fuel Tax Association, comes into play. In this article, we will delve into the world of IFTA, Inc., its history, mission, and the essential services it provides to the trucking industry.

What is IFTA, Inc.?

IFTA, Inc. is a non-profit organization that was established in 1996 to facilitate the administration of fuel tax agreements between jurisdictions. The association is comprised of representatives from various states and provinces in the United States and Canada, who work together to simplify fuel tax compliance for the trucking industry. IFTA, Inc. is headquartered in Tallahassee, Florida, and has over 50 member jurisdictions.

Mission and Objectives

The primary mission of IFTA, Inc. is to promote and facilitate the uniform administration of fuel tax agreements, ensuring that fleet owners and operators can comply with fuel tax regulations efficiently and effectively. The association's objectives include:

Simplifying fuel tax compliance for the trucking industry

Reducing administrative burdens on fleet owners and operators

Promoting uniformity in fuel tax administration across jurisdictions

Providing education and training on fuel tax compliance

Services Provided by IFTA, Inc.

IFTA, Inc. offers a range of services to support the trucking industry in complying with fuel tax regulations. Some of the key services include:

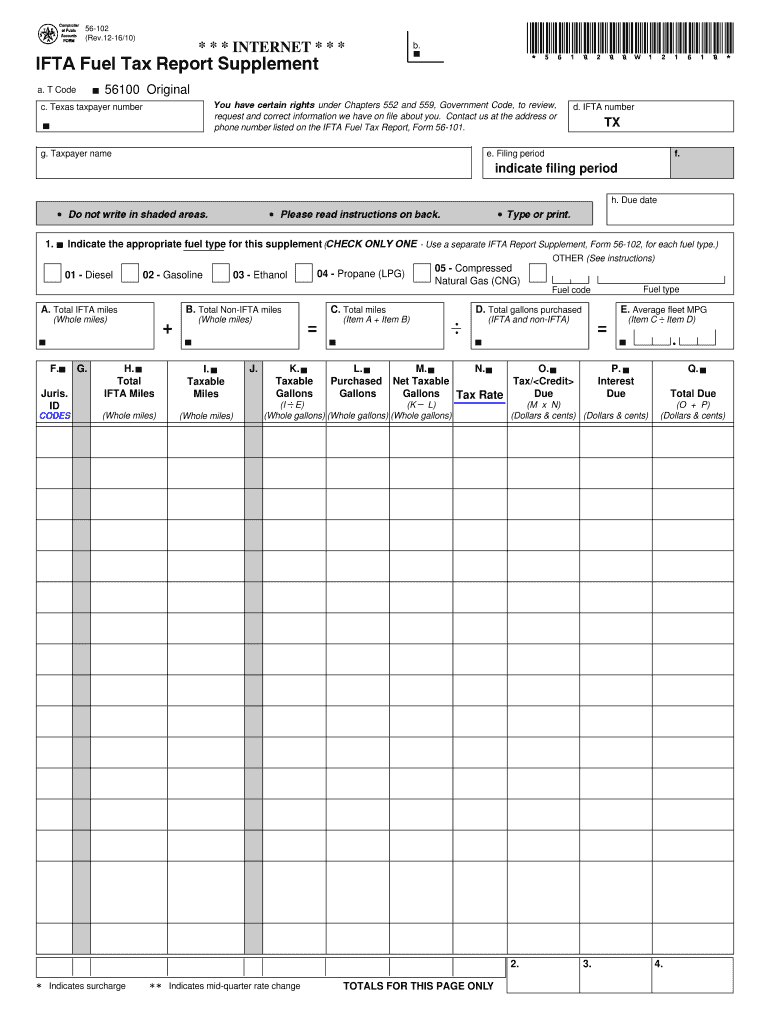

Fuel Tax Permits: IFTA, Inc. issues fuel tax permits to qualified applicants, allowing them to operate in multiple jurisdictions.

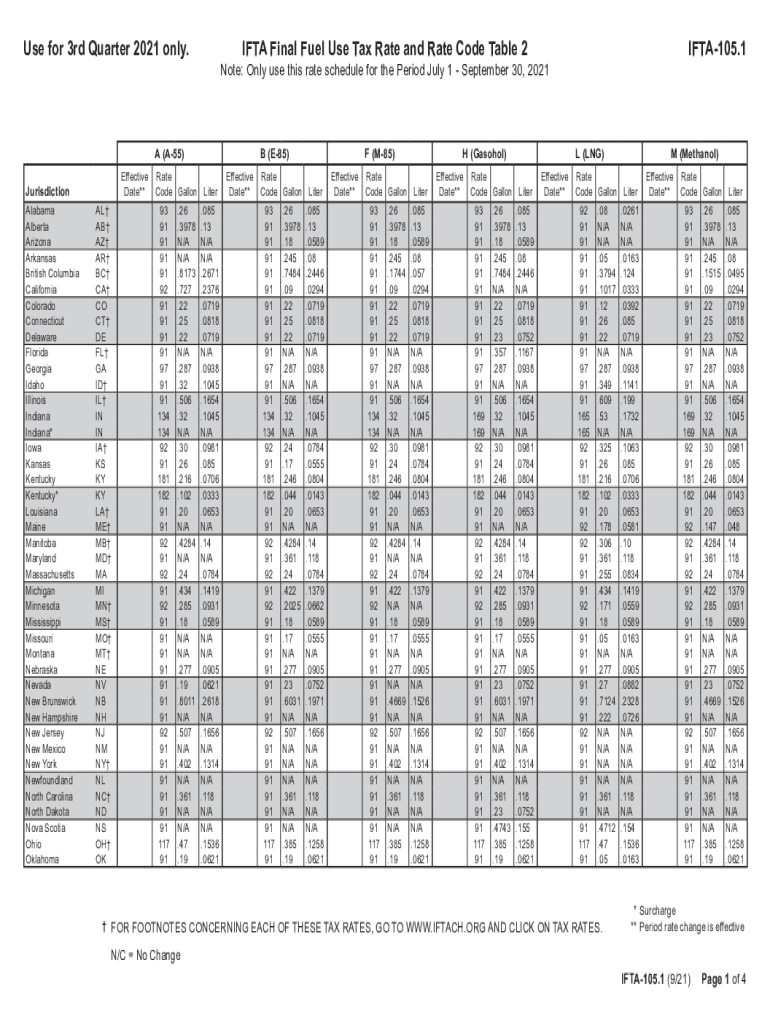

Tax Rates and Schedules: The association provides up-to-date information on fuel tax rates and schedules for each member jurisdiction.

Compliance Audits: IFTA, Inc. conducts audits to ensure compliance with fuel tax regulations and provides guidance on correcting any deficiencies.

Education and Training: The association offers educational resources, workshops, and webinars to help fleet owners and operators understand fuel tax compliance requirements.

Benefits of IFTA, Inc. Membership

Membership in IFTA, Inc. offers numerous benefits to fleet owners and operators, including:

Simplified Fuel Tax Compliance: IFTA, Inc. membership simplifies the process of complying with fuel tax regulations, reducing administrative burdens and costs.

Access to Expertise: Members have access to expert advice and guidance on fuel tax compliance, ensuring they stay up-to-date with changing regulations.

Networking Opportunities: IFTA, Inc. provides opportunities for members to network with other industry professionals, sharing best practices and experiences.

In conclusion, IFTA, Inc. plays a vital role in simplifying fuel tax compliance for the trucking industry. By understanding the association's history, mission, and services, fleet owners and operators can navigate the complex world of fuel tax regulations with confidence. Whether you are a seasoned industry professional or just starting out, IFTA, Inc. is an invaluable resource that can help you stay compliant and focused on your business.