Tax Breaks in the Land of Enchantment: Understanding Taxation and Revenue in New Mexico

Table of Contents

- How to get your 2022 New Mexico tax rebates

- New Mexico Taxation & Revenue Dept. begins issuing 0 rebates | KRQE ...

- New Mexicans can apply for a tax rebate even if they didn't file taxes

- Fillable Online Overview - Taxation and Revenue New MexicoOverview ...

- How to get your 2022 New Mexico tax rebates

- New Mexico Tax Rates & Rankings | Tax Foundation

- New Mexico Adopts Elective Pass-Through Entity Tax Regime

- New Mexico State Tax Form 2023 - Printable Forms Free Online

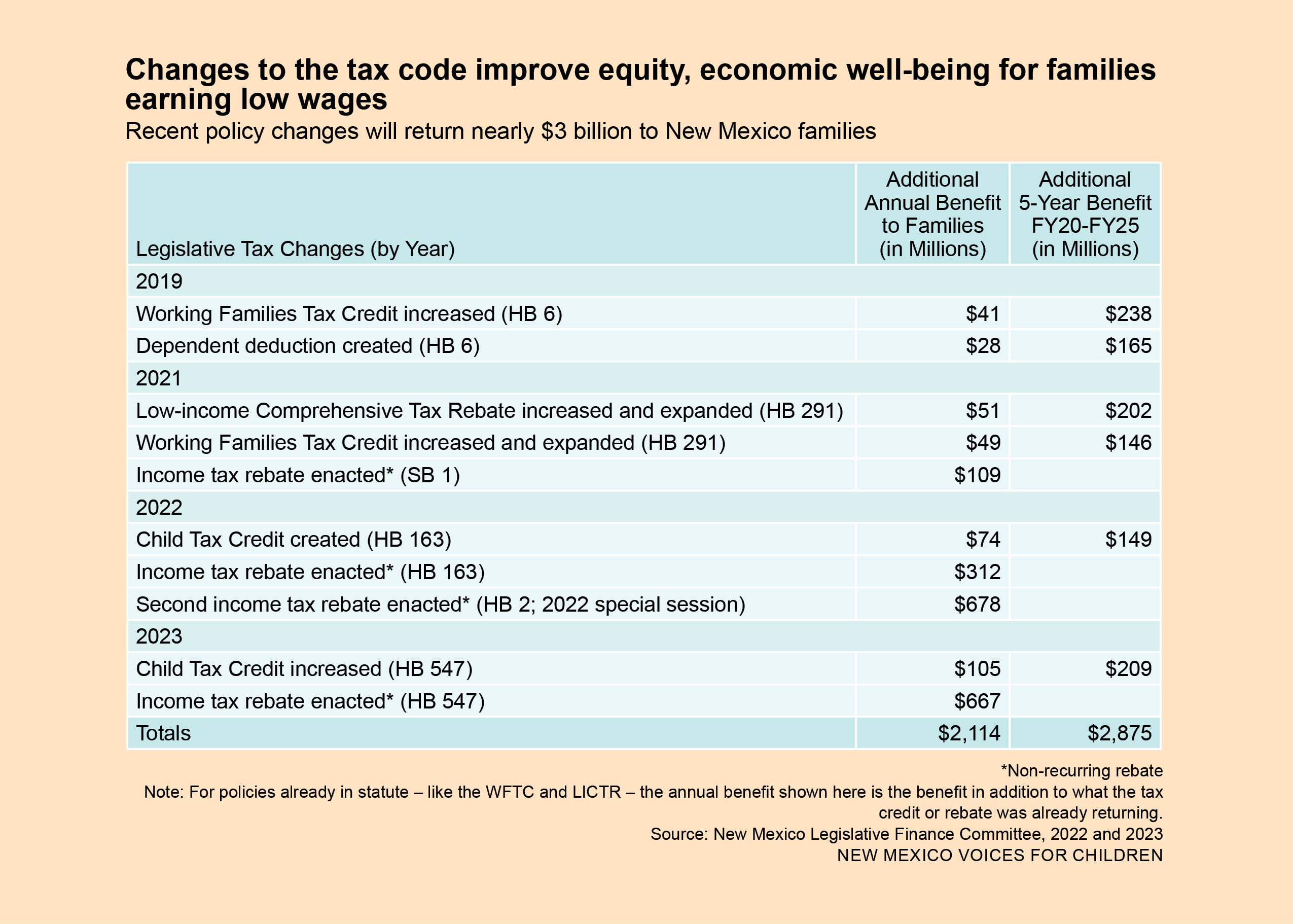

- New Mexico is Putting Families First in Tax Policy – New Mexico Voices ...

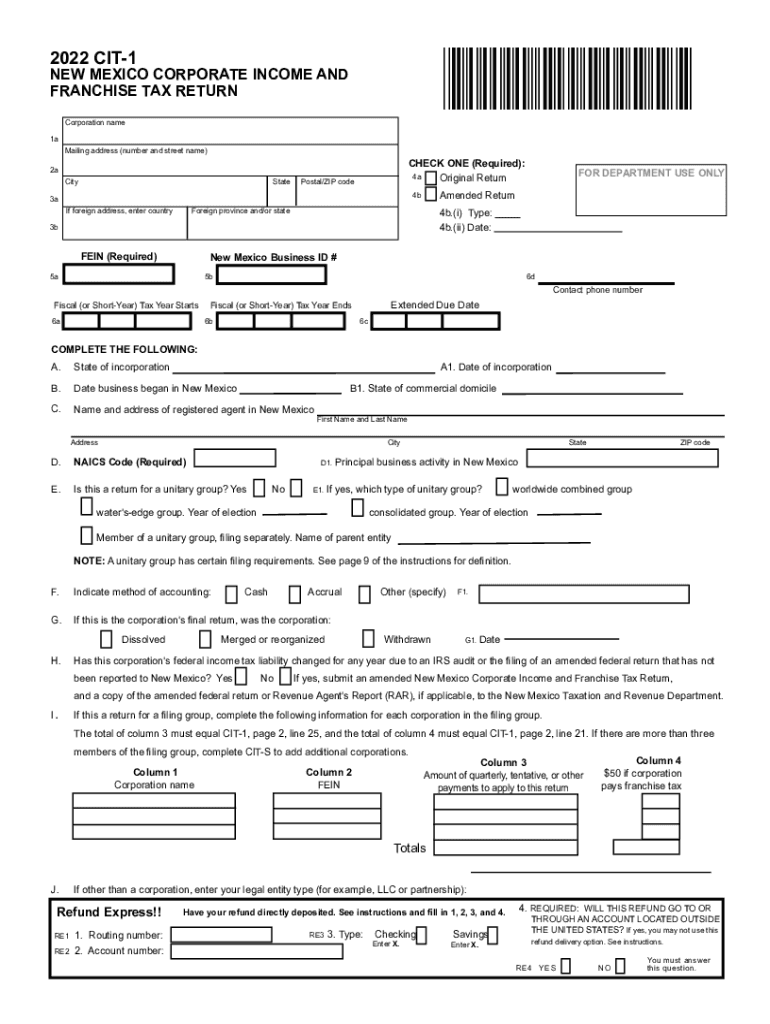

- 2022 cit 1: Fill out & sign online | DocHub

What is a Tax Holiday?

Gross Receipts Tax Holiday

New Mexico's gross receipts tax holiday is a popular incentive for businesses. During this period, businesses are exempt from paying gross receipts tax on certain transactions, such as the sale of tangible personal property. This tax holiday is usually observed in August and applies to businesses with annual gross receipts of $100,000 or less.

Compensating Tax Holiday

The compensating tax holiday is another tax incentive offered by the state. This holiday applies to businesses that pay compensating tax on the sale of tangible personal property. During the holiday period, businesses are exempt from paying compensating tax, which can result in significant savings.

Benefits of Tax Holidays in New Mexico

Tax holidays in New Mexico offer numerous benefits to businesses and individuals. Some of the advantages include: Increased sales: Tax holidays can boost sales for businesses, as consumers take advantage of tax-free shopping. Job creation: By stimulating economic growth, tax holidays can lead to the creation of new jobs and employment opportunities. Revenue growth: Tax holidays can generate revenue for the state, as businesses and individuals invest in new projects and ventures. Tax relief: Tax holidays provide much-needed tax relief to businesses and individuals, helping to reduce their tax burden.

Taxation and Revenue in New Mexico

New Mexico's taxation system is designed to promote economic growth and generate revenue for the state. The state imposes various taxes, including gross receipts tax, compensating tax, and income tax. The revenue generated from these taxes is used to fund public services, such as education, healthcare, and infrastructure development.

Tax Rates in New Mexico

New Mexico's tax rates are competitive with other states in the region. The state imposes a gross receipts tax rate of 5.125% to 8.6875%, depending on the type of business and location. The compensating tax rate is 5.125%, while the income tax rate ranges from 1.7% to 4.9%. Tax holidays in New Mexico are an excellent way for businesses and individuals to take advantage of tax breaks and stimulate economic growth. By understanding the state's taxation system and revenue structure, you can make informed decisions about your business or personal finances. Whether you're a business owner or individual, New Mexico's tax holidays and incentives can help you save money and invest in your future. So, take advantage of these tax breaks and experience the benefits of doing business in the Land of Enchantment.For more information on taxation and revenue in New Mexico, visit the New Mexico Taxation and Revenue Department website.