As we dive into April 2025, it's essential to have a solid savings plan in place to achieve your financial goals. With numerous savings accounts available, choosing the right one can be overwhelming. At finder.com, we've got you covered. Our team has researched and compiled a list of the best savings accounts for April 2025, considering factors such as interest rates, fees, and flexibility.

What to Look for in a Savings Account

Before we dive into our top picks, it's crucial to understand what makes a savings account stand out. When selecting a savings account, consider the following:

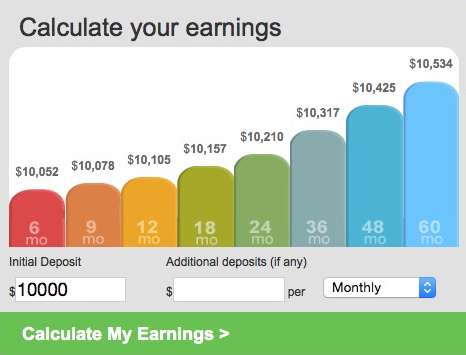

Interest Rate: A higher interest rate can help your savings grow faster.

Fees: Look for accounts with minimal or no fees to maximize your earnings.

Flexibility: Consider accounts that offer easy access to your funds when you need them.

Security: Ensure the account is insured by a reputable organization, such as the FDIC or NCUA.

Best Savings Accounts of April 2025

Based on our research, here are the top savings accounts for April 2025:

1.

Ally Bank Online Savings Account: With a 4.50% APY and no minimum balance requirements, this account is perfect for those who want to earn a high interest rate without any hassle.

2.

Marcus by Goldman Sachs High Yield Savings: Offering a 4.40% APY and no fees, this account is ideal for those who want a straightforward savings experience.

3.

CIT Bank High Yield Savings Account: With a 4.35% APY and a low minimum balance requirement of $100, this account is great for those who want to earn a high interest rate without breaking the bank.

4.

Discover Online Savings Account: This account offers a 4.30% APY and no fees, making it an excellent choice for those who want a hassle-free savings experience.

5.

Capital One 360 Performance Savings Account: With a 4.25% APY and no minimum balance requirements, this account is perfect for those who want to earn a high interest rate and have easy access to their funds.

Finding the right savings account can be a daunting task, but with our expert research and analysis, you can make an informed decision. Whether you're looking for a high interest rate, low fees, or flexibility, our top picks for April 2025 have got you covered. Remember to always consider your individual financial needs and goals when choosing a savings account. By doing so, you'll be well on your way to growing your wealth and achieving financial stability.

Visit finder.com to learn more about these savings accounts and find the best one for you. Our team is dedicated to providing you with the most up-to-date and accurate information to help you make informed financial decisions.

Note: The interest rates and terms mentioned in this article are subject to change and may not be available by the time you apply. Always check the bank's website or consult with a financial advisor for the most current information.