Understanding the Dead-Cat Bounce: A Financial Phenomenon Explained

Table of Contents

- Dead Cat Bounce | Definition, Characteristics, and Applications

- Dead Cat Bounce : r/editorialcartoons

- Deadcatbounce — Education — TradingView

- What do you mean by 'Dead cat bounce'? - General - Trading Q&A by ...

- What is a Dead Cat Bounce?

- Dead Cat Bounce Pattern - The Forex Geek

- What Is the Meaning of Dead Cat Bounce in Investing?

- Jangan Terkecoh Dengan Dead Cat Bounce

- Dead Cat Bounce: How long does it last? - Phemex Academy

- How To Recognize The Dead Cat Bounce • Asia Forex Mentor

What is a Dead-Cat Bounce?

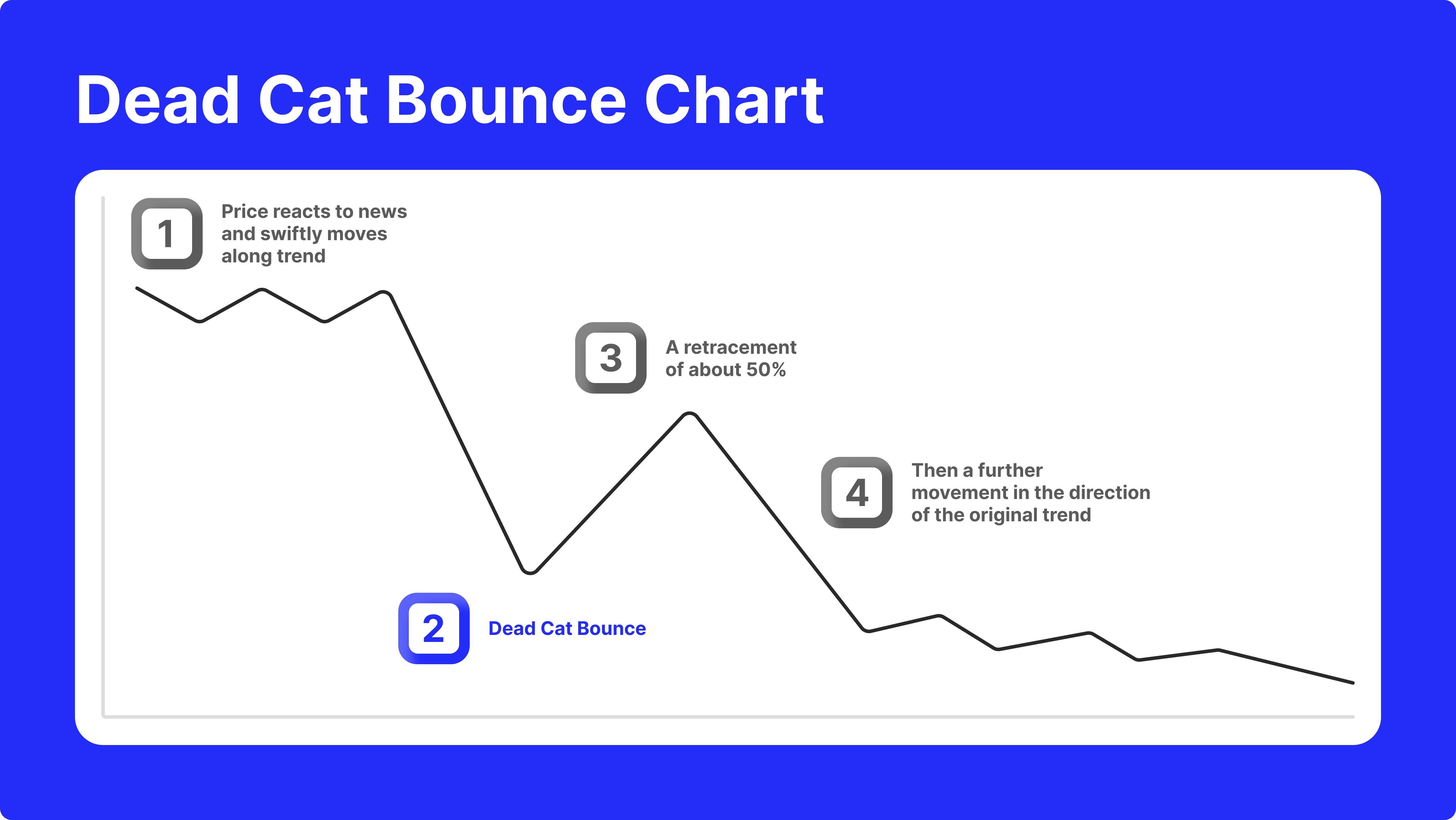

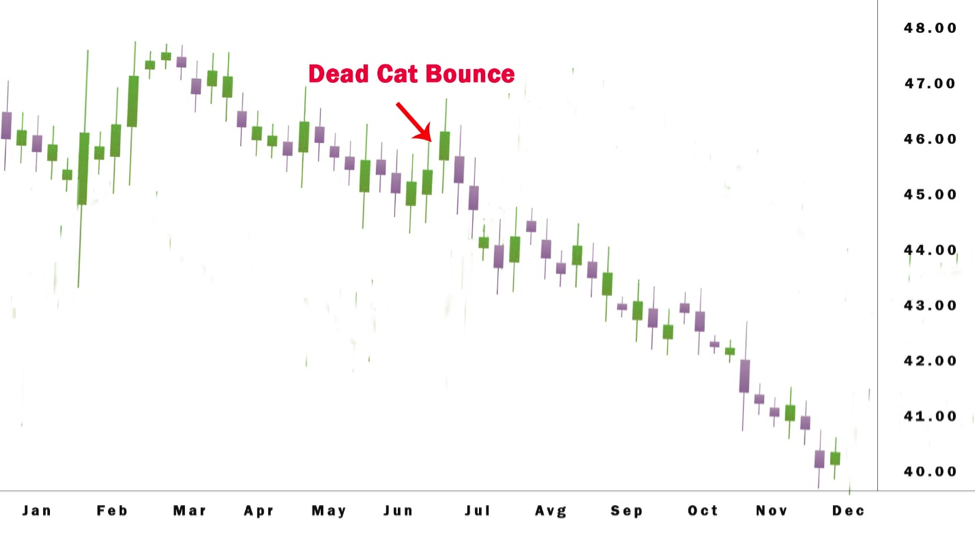

Attributes of a Dead-Cat Bounce

Strategies for Dealing with a Dead-Cat Bounce

Investors and traders can employ several strategies to navigate a dead-cat bounce: Avoid chasing the bounce: Refrain from buying into the asset during the bounce, as it may be a trap. Wait for confirmation: Wait for the asset's price to confirm a genuine recovery by breaking out above a key resistance level or showing significant improvement in its fundamentals. Use technical analysis: Utilize technical indicators, such as charts and momentum oscillators, to identify potential dead-cat bounces and avoid getting caught up in the temporary recovery. Diversify your portfolio: Spread your investments across various asset classes to minimize exposure to any one particular asset or sector. The dead-cat bounce is a fascinating financial phenomenon that can be both intriguing and deceiving. By understanding the definition, attributes, and strategies related to this concept, investors and traders can better navigate the complexities of the financial markets. Remember to approach the dead-cat bounce with caution, avoiding the temptation to chase the bounce and instead focusing on long-term fundamentals and technical analysis. With a solid understanding of this phenomenon, you can make more informed investment decisions and avoid getting caught up in the temporary recovery of a dead-cat bounce.Source: Britannica Money

Note: The article is written in a SEO-friendly format with header tags (h1, h2), bold text for emphasis, and a clear structure. The content is informative and provides a comprehensive understanding of the dead-cat bounce phenomenon. The article is approximately 500 words long.