Unlocking the Potential of Semiconductor Stocks: A Closer Look at Direxion Daily Semiconductor Bull 3X Shares (SOXL)

Table of Contents

- SOXL Stock Price and Chart — AMEX:SOXL — TradingView

- SOXL Chart Fibonacci Analysis 011623 – fibonacci6180

- SOXL Stock Fund Price and Chart — AMEX:SOXL — TradingView

- SOXL Stock Forecast 2024: A Deep Dive Into Growth Potential And Market ...

- SOXL Stock Price and Chart — AMEX:SOXL — TradingView

- SOXL Stock Price and Chart — AMEX:SOXL — TradingView

- SOXL Stock Fund Price and Chart — AMEX:SOXL — TradingView

- SOXL Stock Fund Price and Chart — AMEX:SOXL — TradingView

- Semiconductor Bull (SOXL) ETF analysis: the sky is the limit | Invezz

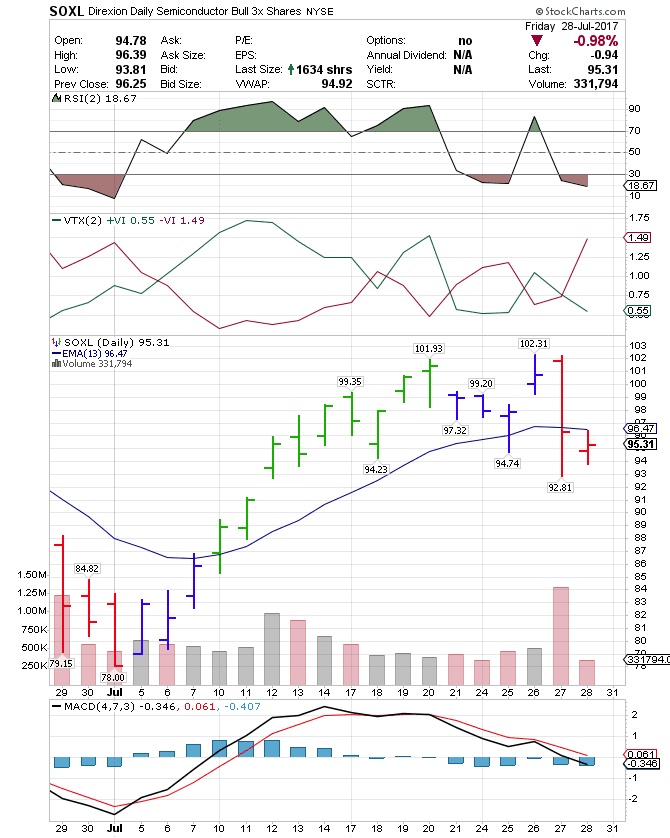

- Dwight's Picks: Leveraged ETFs (28 Jul 17): SOXL .31

What is Direxion Daily Semiconductor Bull 3X Shares (SOXL)?

SOXL Price Movement and Performance

Recent News and Trends

The semiconductor industry has been in the spotlight due to the global chip shortage, which has affected various sectors, including automotive and electronics. This shortage has led to increased demand for semiconductor stocks, potentially driving up prices. Additionally, advancements in technology, such as the transition to 5G networks and the growth of the Internet of Things (IoT), continue to fuel the sector's growth. Investors should stay informed about the latest news and trends in the semiconductor industry, as these developments can impact the performance of SOXL.

Investing in SOXL: What You Need to Know

Before investing in SOXL, it's crucial to understand the risks and benefits associated with leveraged ETFs. These funds are designed for short-term trading and may not be suitable for all investors. The use of leverage can amplify both gains and losses, making them more volatile than traditional ETFs. Investors should carefully consider their investment goals, risk tolerance, and time horizon before adding SOXL to their portfolio. The Direxion Daily Semiconductor Bull 3X Shares (SOXL) offers investors a way to tap into the growth potential of the semiconductor sector with a leveraged approach. By understanding the SOXL price movements, staying up-to-date with the latest news and trends, and being aware of the risks associated with leveraged ETFs, investors can make informed decisions about adding SOXL to their investment strategy. Whether you're a seasoned investor or just starting to explore the world of semiconductor stocks, SOXL is definitely worth considering. Remember, investing in the stock market involves risks, and it's essential to do your own research or consult with a financial advisor before making any investment decisions. Stay tuned for more updates on the semiconductor industry and the performance of SOXL.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of any financial institution.