Unlocking Your Financial Future: A Comprehensive Guide to TransUnion Credit Reports

Table of Contents

- TransUnion Stock: Treasure Trove Of Big Data With 0B TAM (NYSE:TRU ...

- TransUnion Reviews and Complaints @ Pissed Consumer Page 2

- Online Personal Credit Reports & Credit Scores - TransUnion Credit ...

- Improve Your Credit Score with TransUnion: Insightful Tips & Tricks ...

- What does Transunion check for? - YouTube

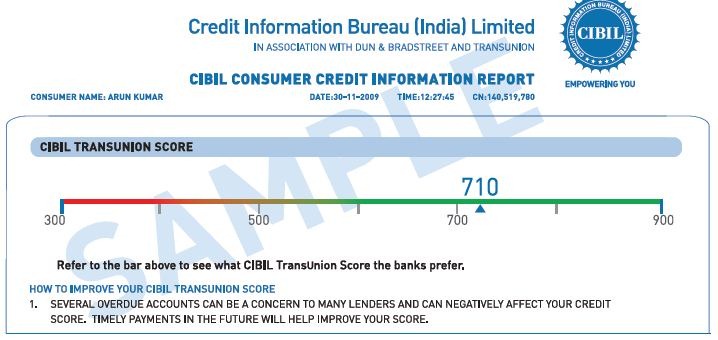

- Sample Credit Report Transunion

- Sample Credit Report Transunion

- TransUnion is Hiring Entry-level Data Engineers, Multiple Locations ...

- How To Get My Free Transunion Credit Score

- TransUnion

What is a TransUnion Credit Report?

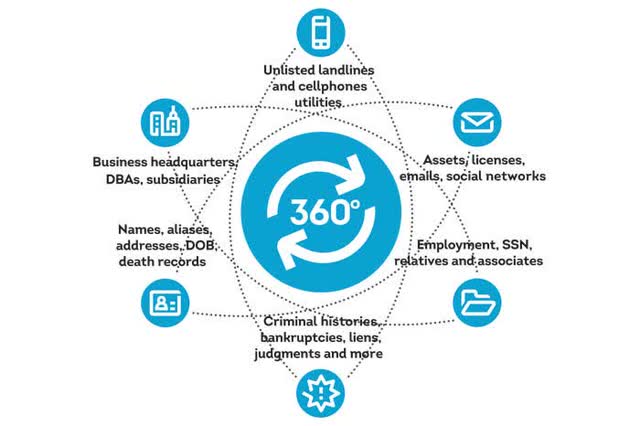

What Information is Included in a TransUnion Credit Report?

Why is a Good TransUnion Credit Report Important?

A good TransUnion credit report is essential for several reasons: Loan Approvals: A good credit report can increase your chances of getting approved for loans and credit cards Interest Rates: A good credit score can help you qualify for lower interest rates on loans and credit cards Credit Limits: A good credit report can help you qualify for higher credit limits Employment and Housing: Some employers and landlords use credit reports to evaluate your creditworthiness

How to Check Your TransUnion Credit Report

You can check your TransUnion credit report for free once a year from the official website of TransUnion. You can also purchase a copy of your report from the website or request a free report by mail. It's essential to review your report regularly to ensure that it's accurate and up-to-date. In conclusion, a TransUnion credit report is a vital tool for maintaining good financial health. By understanding what's included in your report and how it's used, you can take steps to improve your credit score and increase your chances of getting approved for loans and credit cards. Remember to check your report regularly and dispute any errors to ensure that your credit report is accurate and reflects your true creditworthiness. By taking control of your credit report, you can unlock your financial future and achieve your long-term goals.Keyword: TransUnion Credit Report, Credit Score, Financial Health, Credit Report Agencies, Loan Approvals, Interest Rates, Credit Limits, Employment, Housing