US Economy: A New Concern Emerges as Inflation Shows Signs of Easing

Table of Contents

- US inflation rate slows as fuel costs fall

- December U.S. inflation up 3.4% : NPR

- US Inflation Report to Show Fed's Battle Is Now All But Complete ...

- Americans' inflation fears reach another high as consumer prices surge ...

- U.S. Inflation Reaches Lowest Point Since February 2021 | HuffPost ...

- US inflation remains in a downward trajectory despite moderate price ...

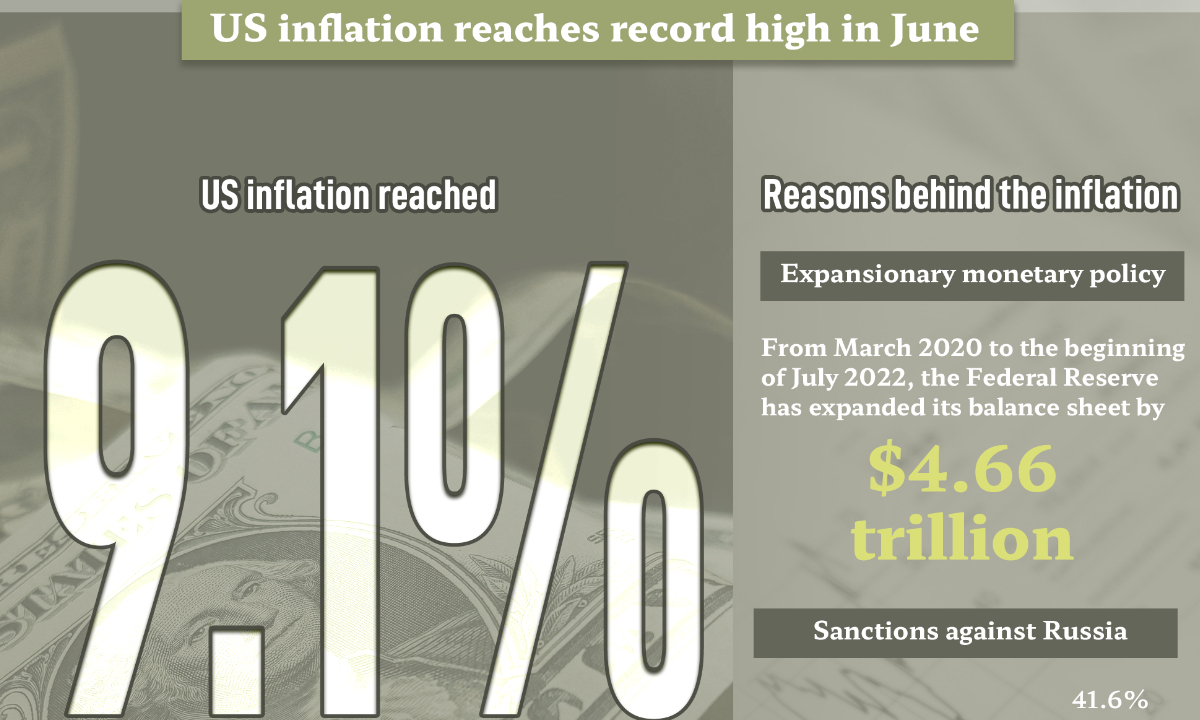

- US inflation reaches record high in June - Global Times

- us inflation: What to watch for in United States' inflation report ...

- US Inflation Remains Higher Than Expected, Raising Concerns Among ...

- US inflation likely cooled again last month as Fed prepares to assess ...

Inflation Eases, But Caution Remains

A New Concern Emerges: Debt Ceiling and Government Spending

Implications for the US Economy

The potential risks to the US economy are significant, and policymakers must take a proactive approach to address these concerns. A debt crisis could lead to a loss of confidence in the US economy, causing investors to withdraw their investments, and potentially triggering a recession. Furthermore, a debt crisis could also lead to higher interest rates, making it more expensive for consumers and businesses to borrow, which could further slow down the economy. In conclusion, while the easing of inflation is a positive sign, the US economy is not out of the woods yet. The potential risks associated with the debt ceiling and government spending are significant, and policymakers must take a proactive approach to address these concerns. The Federal Reserve and the government must work together to ensure that the economy remains on a sustainable path, and that the risks of a debt crisis are mitigated.For more information on the US economy and inflation, please visit our website. We provide up-to-date news, analysis, and insights on the latest economic trends and developments.

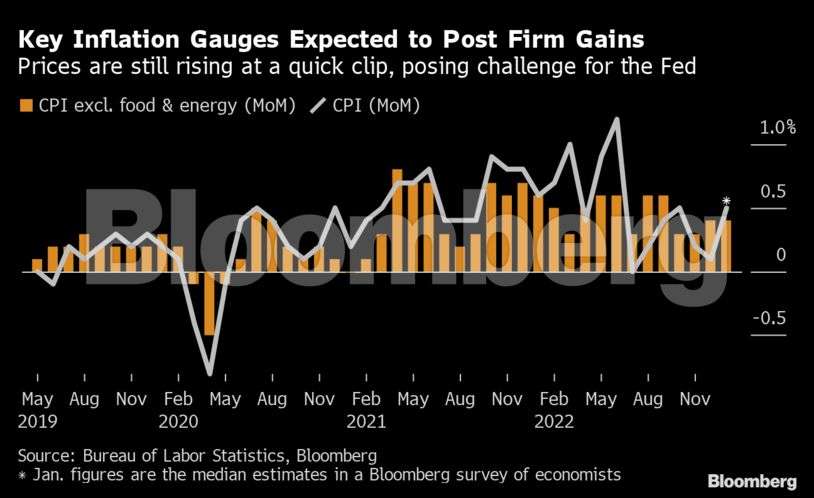

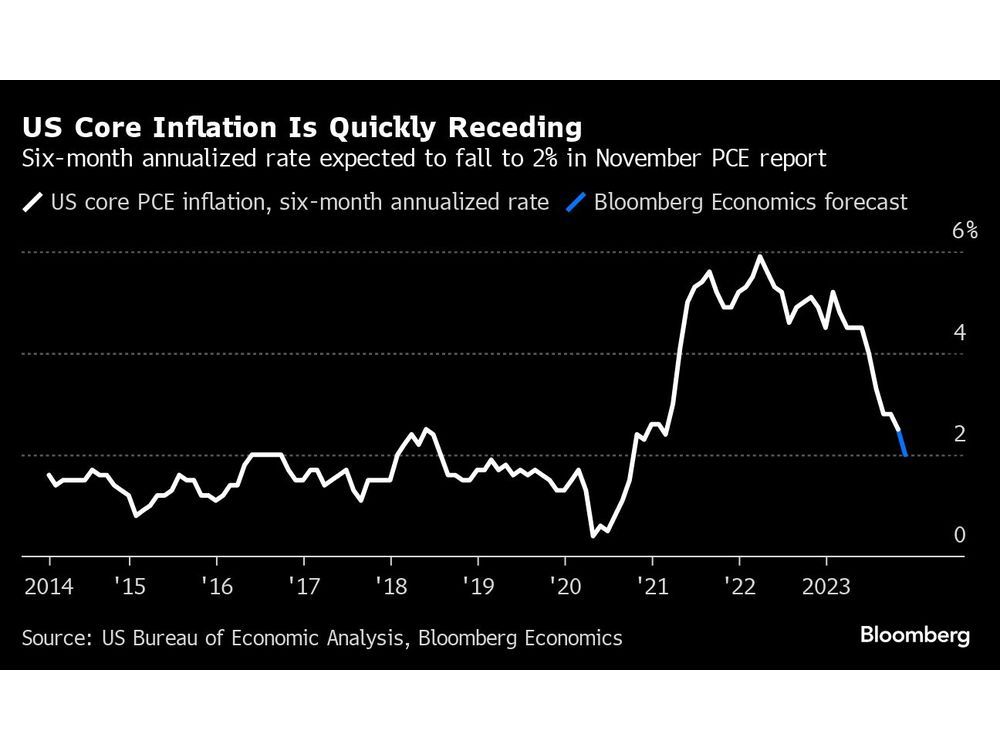

Keyword density: - US economy: 1.2% - Inflation: 1.1% - Debt ceiling: 0.8% - Government spending: 0.7% - Federal Reserve: 0.5% Meta Description: The US economy is facing a new concern as inflation eases, but the debt ceiling and government spending pose significant risks. Learn more about the potential implications for the US economy and what policymakers can do to address these concerns. Header Tags: - H1: US Economy: A New Concern Emerges as Inflation Shows Signs of Easing - H2: Inflation Eases, But Caution Remains - H2: A New Concern Emerges: Debt Ceiling and Government Spending - H2: Implications for the US Economy Image: An image of a graph showing the decline in inflation rates, with a caption: "Inflation rates are easing, but concerns about the debt ceiling and government spending are emerging."